The Perfect Christmas Loan

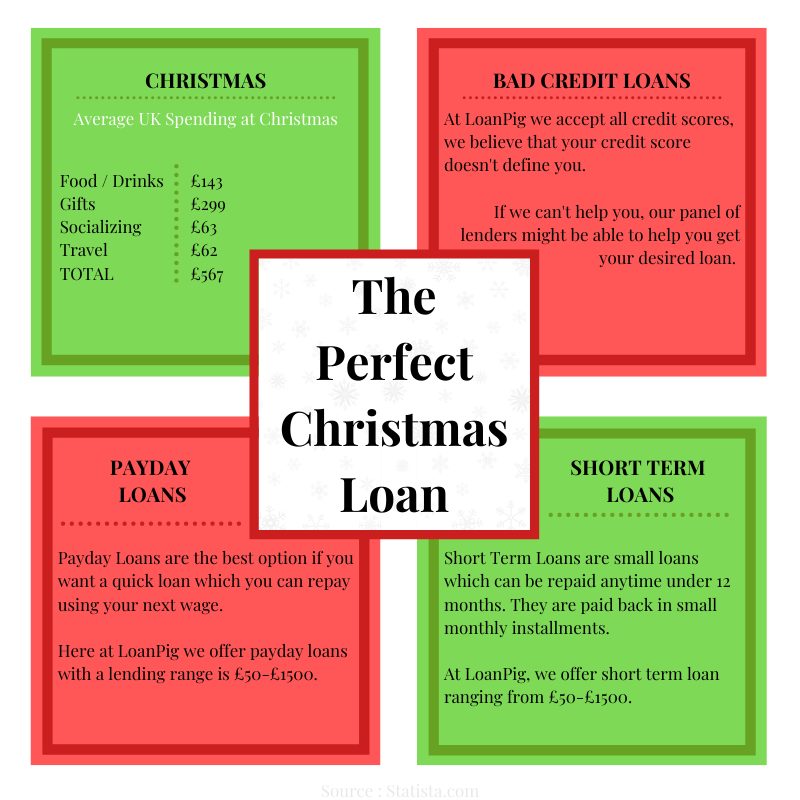

We all know that Christmas is the most expensive time of year, but we believe it is also the best time of year. Even if the food, drinks, decorations and presents all add up to a hefty sum of money which nobody likes to spend, the overall experience is incredible. So, have you ever considered taking out a loan to help you fund the festive period? It might be the best option for you!

Payday Loans at Christmas

Payday Loans seem to be the best option around Christmas time due to the high demand for extra funds for the exciting season.

The most common UK payday still stands at the last working day of the month, meaning payday will be after Christmas. Payday loans were designed to tide you over until your next payday, making it the perfect solution at Christmas time. At BingoLoans you can take out a payday loan before Christmas and pay it back including interest using your next wage, keeping the Christmas period entirely stress free.

Short Term Loans at Christmas

Short Term Loans are similar to payday loans in the sense that you can borrow between £50 and £1500, but the repayment period is much longer with a short term loan. For example, when taking out a short term loan, you can repay it back anytime between 1 month and 12 months whereas with a payday loan you must repay with your next wage. So, depending on how much you are wanting to borrow, maybe a short term loan is the better choice.

With Christmas being the most expensive time of year, loans become more of a popular option. Doesn’t it sound good to be able to get a loan to cover the cost of your Christmas this year? According to ThatSweetGift, 12.2% of people take out a loan to cover the cost of the festive period.

pplying for a loan with BingoLoans is simple, all you need to do is fill in the application form found here, or visit our website.

Why choose us?

Here at BingoLoans, we have access to the UK’s largest panel of lenders making it easier for you to receive your desired loan. So, if we are unable to help you with your loan request, it is likely that another lender within our panel will be able to help.

Along with this, we accept bad credit scores to give you a fairer chance of being able to get your hands on a loan. Although we do look at your credit score, we also consider other aspects like your income and whether or not your income can cover the minimum repayments.

When applying for a loan, please make sure that you fit our lending criteria, otherwise, you won’t be accepted:

- Be over 18 years olds

- Be a UK resident

- Have a stable source of income or be employed

- Meet the affordability and credit checks which we and our lenders request

Do you think that a loan is a good option for you?